Asset Based Lending in Atlanta, GA and Nationwide

Our asset-based loans in Atlanta, GA and nationwide provide funding to assist business owners in obtaining inventory and equipment, as well as the financing of real estate or accounts payable. Applicants will be required to provide proof of assets and financial statements as collateral. However, these loans are more attainable for those with a less than perfect credit history because they do not require business owners to use their own credit score.

What is Asset-Based Lending?

Commonly referred to as asset-based loans or ABL loans, this refers to business loans secured with the use of an asset as collateral to repay a business’s debt instead of relying on just cash flow or credit score. The company has the ability to immediately use all the cash in the company’s account payable account, the agreed-upon value of equipment or property, or stock on hand, whatever asset is used as the basis for the loan. Asset-Based loans can be shaped as revolving credit instruments, enabling a business to reinvest or use assets to cover the costs of its operations.

Asset-based lenders will advance funds based on an agreed percentage of the secured assets’ value. The percentage is generally 70 percent to 80 percent of eligible receivables and 50 percent of finished inventory.

What is ABL Finance?

ABL finance is the process of evaluating assets as a viable form of leverage in support of a loan. ABL financiers want to determine if the asset has sufficient value to back up the loan, but they aren’t just interested in the value of your asset. They also want to determine if the cash flow will be sufficient to pay off the loan. They only want to seize assets as a last resort. That’s why Asset Backed Financing firms look at your overall borrowing to make sure you are not over leveraged. An over leveraged business will be at risk of default because revenue may not be sufficient to cover the costs of the loans and the cost of operations, marketing and profit.

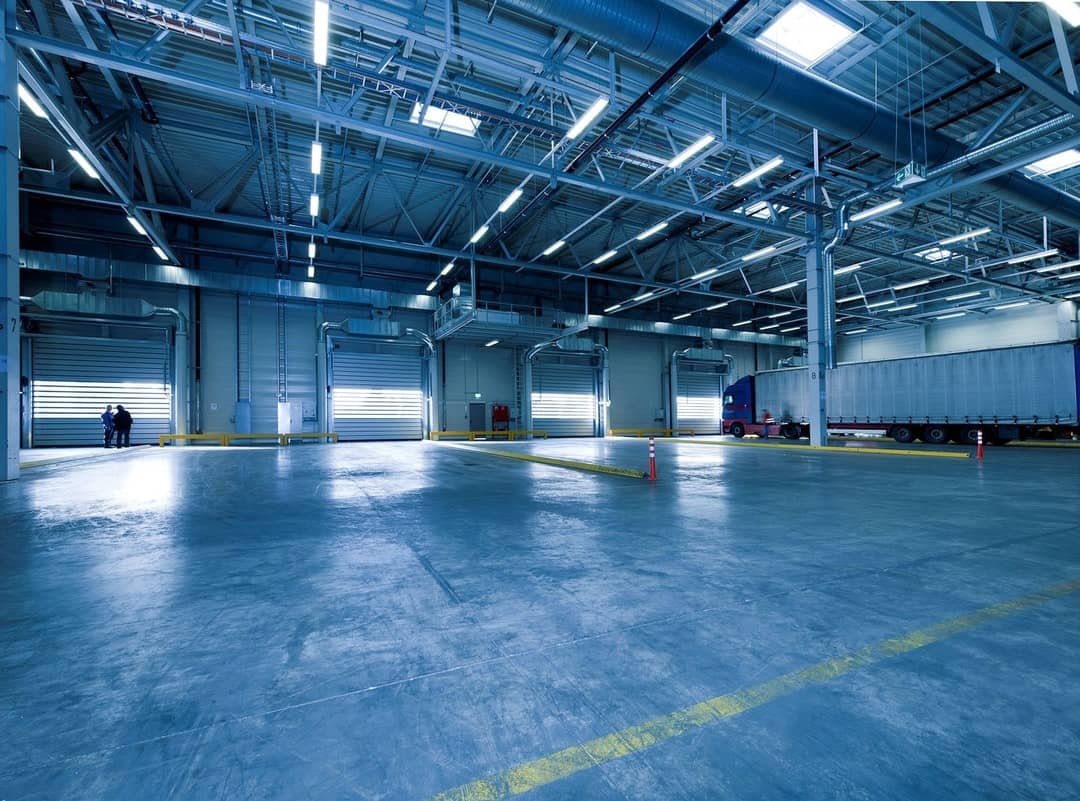

Inventory Financing

An Inventory Asset Loan is typically secured by the value of what is being purchased. Qualified applicants must show that the loan can be repaid with the sale of the inventory. Our Inventory loans serve business owners who have been denied a conventional loan due to credit history or some other factor.

If proper requirements are met, funding may be provided for up to 90% of the cost of the inventory. Inventory loans cannot be used for the purchase of property for its potential future value, or for the purchase of real estate. Asset Based Inventory Loans are the easiest option in terms of repayment and collateral requirements for the purchase of inventory.

Commercial Real Estate

An asset-based Commercial Real Estate Loan is based on the value of a business’s real estate. The property owned by the business applying for the loan will be used as collateral to secure the note. This collateral provides the lender with the additional security needed to provide financing for businesses that have a less than stellar credit history.

Funding can be provided for up to 90% of the value of the property, and unlike the more traditional real estate loans, asset-based real estate loans allow funds to be used for a variety of business needs such as smoothing over cash flow issues, or funding expansion outside of real estate.

Accounts Receivables

An accounts receivables loan is based on the amount of owed money coming into a business in the future through invoices, or billing. Funds can be used for daily operations, including the purchase of inventory, employee wages, and utility payments.

Small businesses with 2 years’ prior tax returns and proof of ability to repay the loan are easily qualified for up to 100% financing. Our accounts receivables loans are repaid as funds become available and typically carry a low APR. In addition, A/R loan credibility is typically based on the creditworthiness of a company’s invoiced customers, making it a great fit for businesses with a strong client base, but weaker credit history.

Equipment Loans

Our Asset-based equipment loan amounts are calculated using the value of the businesses already owned equipment. To qualify, the equipment must have long-term value, and be used solely for business purposes. Our asset-based equipment loans can be used for the purchase of upgrades, construction, and daily operations.

Funding is provided based on the value of equipment, and that same equipment will be used as collateral for the loan. With up to 90% financing available, and an APR between 5% and 15%, this loan is readily available to small businesses with a less than desirable credit history.

Hard Money Loans

Our asset-based hard money loans are typically secured by real property, and last a few months to a few years in length. Similar to a bridge loan, hard money loans provide funding to assist in a temporary financial situation, or while your business is waiting for their long-term financing to be approved.

Our hard money loans are available even if the real property owner is in a distressed financial situation. Funding for up to 75% of the value of the collateral property is often available and can be used for a variety of business operations including the purchase of inventory or stock, employee wages, and insurances, and construction or landscaping projects. Uniquely, hard money financing requires payment only on the interest of the loan, with the final balance due at the end of the term.

Acquisition Financing

An important part of business growth is the acquisition of real estate. Most businesses are eligible for acquisition financing, and funds can be used for purchasing real estate for storage, expansion, or owner occupation.

Loans acquired for the purchase of commercial real estate are typically long-term, 10 to 20 years, and usually the business is responsible for a 10% down payment.

Acquisition financing loans typically carry low-interest rates, and easy terms, making it easily attainable by small business and making it far less stressful for business owners to purchase property. New businesses can use the funds to purchase their first building, while seasoned businesses may use funds to expand or franchise their business.

Pursuing an ABL Line of Credit

One option for borrowers seeking an abl loan is to pursue an ABL line of credit. Because the line of credit is backed by assets, the borrower can receive a lower interest rate than with an unsecured line of credit or business credit card. One option for an asset based line of credit is to secure the line against the goods sold. This creates a way for businesses to effectively manage their open to buy dollars – leverage the value of goods carried by your business and use the line of credit to purchase items that will move fast and that have a high margin.

What is a Borrowing Base Certificate?

A borrowing base certificate lists all of your available assets that can be used as collateral for your ABL loan.

This is used with the discount rate of your asset based lender to determine the borrowing base and is the formal calculation the lender uses to determine the maximum amount of financing they can offer.

Calculating the Borrowing Base in Asset Based Lending

The borrowing base is the maximum amount of money that can be borrowed with an asset backed loan. To calculate the borrowing base for an asset based loan, total up the value of all your current assets such as inventory, equipment and accounts receivable. Then multiply your collateral amount by the percentage at which the lender is willing to loan to you.

Working with an Asset Based Lender

Each Asset Based Lender has an area of expertise. For example, a company that provides an assets loan backed by commercial real estate may not be well suited to loan against other assets, such as advanced medical equipment. That’s why we recommend working with an experienced loan broker or direct lender, such as Peach Tree Commercial Capital. Because of our experience working with borrowers as an asset lender, we are able to provide the experience necessary to help you through the process to a successful close of an assets backed loan. We will also help you evaluate if an assets backed loan is the right choice, then pair you with the right Asset Based Lending Agent to facilitate a sound deal based on your business objectives.

Phone

678-269-4020

info@peachtreecap.com

Address

Marietta, GA 30062